Debt collection agencies bring professionalism and experience to your collection efforts. They have the resources to increase your cash flow while reducing expenses. However, finding the ideal recovery company is challenging for most businesses. There are many debt collection agencies, but the one you choose must suit your needs.

In general, you want to start by ensuring any agency you choose has a license to practice within your jurisdiction. Then, assess whether they have the human and technological resources to execute. Finally, review their track record. The agency you partner with should have the experience to deliver as expected.

Why Do You Need a Collection Agency?

Working with top-rated collection agencies comes with many benefits, including the following:

1. Experience and Professionalism

Debt collection agencies retrieve debts for businesses and have experience with various industries. They can find practical solutions to diverse problems while maintaining high professionalism. Collection agencies also comply with laws like the Fair Debt Collection Practices Act (FDCPA), the Fair Credit Reporting Act (FCRA), and other industry standards.

You can leverage debt collection services for recovery efforts that demand legal action. Collectors can assess your claim and work with attorneys to protect your interests. Such arrangements can streamline debt collection, increasing the size and speed of recoveries.

2. Cost Reduction

Hiring a third-party debt collector often costs less than staffing an in-house collections department. It eliminates expenses like wages, benefits, training costs and certification fees. You also get access to resources like skip-tracing databases and analytics software. These innovations are often expensive to build and manage.

Outsourcing debt collection is a cost-effective strategy for most businesses. It allows you to focus on the core operations while a professional handles receivables management. These agencies have a committed team with resources to help you retrieve payments due. Choosing the right collection agency can also increase your return on investment (ROI).

3. High Efficiency and Effectiveness

Third-party debt collection agencies can improve your recovery efforts. They use tried and proven methods and can provide tailored advice where necessary. This effectiveness explains why top organizations prefer leveraging debt management professionals.

Collection agencies have high recovery rates. They can collect more debts in less time, which is vital to increasing business cash flow. Collectors also take the burden off your shoulders. You can shift that energy, time, and money into other important areas of your business. Optimizing operations in this manner drives growth.

4. Advanced Technology

Debt collection efforts have changed over the years. Companies now use advanced technology for tasks like reporting, skip-tracing, and behavioral analysis, increasing performance significantly. However, it can be costly for organizations to invest in and maintain these technologies if they aren’t closely related to their main business.

Collection agencies invest in these technologies because they need them to work. Thus, partnering with them allows you to profit from their investments indirectly. Digital tools streamline workflow, enabling the agencies to execute faster. Additionally, they can easily retrieve records if you need them in the future.

How to Hire a Collection Agency

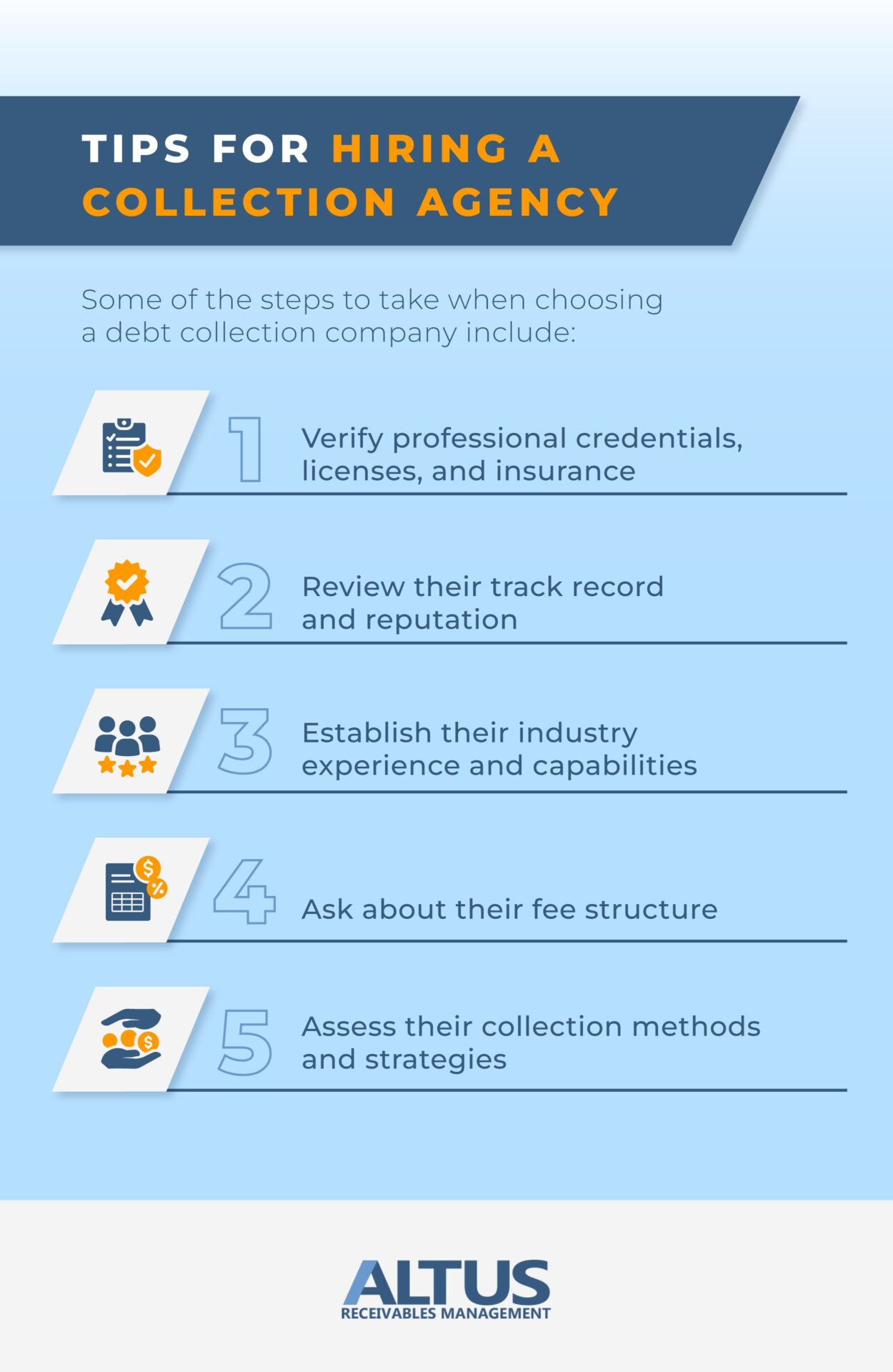

These are the steps to take when choosing a debt collection agency:

1. Assess Your Needs and Research

First, examine the scale and frequency of your debt collection needs. Do you need ongoing assistance or sporadic debt recovery services? Do you collect large amounts? Can the debt collection agency offer services beyond your capabilities? This assessment is straightforward, but it informs you about the kind of agency to choose.

Second, do intensive research before making a decision. That will require effort, but doing due diligence is crucial. Identify different debt recovery companies based on your needs and rank them according to preference. Be flexible about adding or removing any company from your list of potential partners, depending on the information you gather. The internet is a good starting point, but ask trusted people for referrals. We discuss this in more detail later.

2. Verify Professional Credentials, Licenses, and Insurance

Professional debt collection agencies must comply with industry standards and ethics to safeguard customers’ interests and maintain the industry’s integrity. Thus, it’s essential to confirm whether the agency is a member of a professional body and is in good standing. Knowing that a higher authority supervises the agency handling your money is comforting. Look for debt collectors accredited by industry watchdogs like the following:

- The Commercial Law League of America

- The International Association of Commercial Collectors

- The Credit Research Foundation

Also, check whether they have the license to practice within the jurisdiction. If you work in different parts of the country, choosing an agency with a nationwide license is best. Similarly, businesses that work outside the United States should prioritize internationally licensed collectors. That helps you save money and time.

Finally, choose a debt collector with adequate insurance coverage. Insurance can protect you against financial losses from lawsuits and reputational damage. You may request proof of insurance to clear all doubts.

3. Review Track Record and Reputation

Hiring a professional debt collector is an investment, so ensure you get value for your money. Their reputation brings added value, especially when they are respected for their work. They represent your brand and can impact how others perceive your company.

Get referrals from trusted individuals and organizations to learn more about the agency. You can contact institutions like the Chamber of Commerce and the Better Business Bureau for customer complaints. The response you receive can go a long way.

Also, ask the agency to provide references from previous clients to prove their credibility. Online reviews and testimonials are good sources of information, too. This will give you an insight into how the debt collection agency does business and its success rate.

4. Examine Experience and Capabilities

Many debt collection agencies exist but with varying experiences and capabilities. An agency may have experience dealing with individuals but little knowledge of businesses. Others may also specialize in one industry without exposure to the other.

The debt collector’s industry expertise is a crucial determining factor. Collectors with years of experience in a field are likely to outperform the others. They can handle disputes, negotiate, and recover debts with higher success rates.

5. Consider Technology

Almost every debt collection agency uses some technology, albeit at varying levels. The best debt collection agencies have advanced software to exceed expectations. It enables them to perform various tasks, including the following:

- Smart outreach

- Credit and risk scoring

- Collections automation

- Real-time report generation

- Robust tracking and metrics

- Payment receipt through multiple digital platforms

Debt collection technology is a necessity regardless of your company size. Both small and large businesses profit from their capabilities. The industry has grown competitive over the years, so it’s best to partner with a company that can execute.

6. Prioritize Return on Investment

Most businesses select the most affordable options when choosing debt collectors. While that makes financial sense at first glance, it can cost more long term. Instead, select a company that can increase your ROI and has a high recovery rate. That’s a better reflection of profitability on expenditure. Here’s an example.

Suppose Agency A charges 12% of the recovered amount while Agency B charges 40%. Agency A has a recovery rate of 7%, whereas Agency B has a recovery rate of 25%. If the amount owed is $50,000, Agency A is likely to recover $3,500. However, Agency B will likely recover $12,500. After charges, the cash returned to business from Agency A is $3,080, but Agency B will return $7,500.

Remember to examine the collector’s track record and experience. They must understand your industry and have the resources to execute as advertised. Results mean more when investing, so strategize to get the most value for your money.

7. Inquire About the Fee Structure

Collection agencies have different fee structures. Some have a fixed rate, while others charge on a percentage basis. It’s vital to consider which options best suit your needs before deciding. To make things clearer, let’s consider how each works:

- Flat fee: The debt collection agency charges a fixed amount regardless of the size of the debt. It’s straightforward but is usually reserved for small collections. Also, the debt collector often charges in advance, so you pay whether they fail or succeed.

- Percentage-based fee: The collection agency charges a percentage of the debt, which may vary depending on the amount, the duration of the debt, and the number of contacts made. Sometimes, the collector only receives payment if they recover your money. This method is often used for large collections and is the most common option.

8. Emphasize Standards and Values

Businesses must maintain integrity and gain clients’ trust for sustainable growth. Trust increases client retention and attracts new customers to your company. Thus, choose an agency that can safeguard your hard-earned reputation. They must understand and respect your values and strive to uphold them.

The debt collection process can be challenging. Yet it’s vital to be reasonable and respectful. The agency cannot harass or abuse clients. They must not threaten to harm the debtor or destroy their properties. Similarly, threatening with legal actions or making false representations are unlawful.

Adhering to ethical standards and laws is essential. But traits like diligence and honesty also have real value. When shopping for collection agents, list the values you cherish most. Then, research whether the company checks off most, if not all, of the boxes.

9. Learn About Reporting

The best debt recovery companies provide timely, accurate, and complete statements. This is crucial for the following reasons:

- Debt recovery performance tracking: Reporting helps you assess recovery success. It provides clear performance insights, which enables you to track your ROI and cash flow. Reporting can also help you compare your performance with competitors.

- Accountability and transparency: Transparency and accountability establish trust among stakeholders, including debtors. It also facilitates productive relationships, which is essential in competitive industries.

- Decision-making: Reports can provide invaluable information to make informed decisions. You can study trends, debt recovery rates, and other metrics to develop strategies. This helps optimize your collection efforts while mitigating risks.

10. Assess Collection Methods and Strategies

Collection agencies have different recovery techniques. These techniques impact results and can also affect your company’s reputation. Hence, it’s vital to compare how different agencies work to make the ideal choice.

The best collection agencies combine different techniques during a collection cycle. They ensure each approach meets industry standards while optimizing collection efforts. For example, they know when to issue demand notices and the right time to institute legal action.

The processes may be similar across different agencies, but the implementation may vary. An agency combining debt collection software with high-level professionalism will likely perform better. That’s the kind of service you must insist on.

11. Observe Customer Service and Relationships

Choose a debt collection agency with excellent customer service. Your relationship with the company is as essential as their collection exercise, so strive to find a long-term partner. Your debt collection partner must be willing to serve and make things easy for you. Here are five questions you should ask when doing research:

- Do they have a flexible payment plan?

- Do they have multiple payment channels?

- How easy is it to reach the debt recovery agency?

- Do they provide regular updates and progress reports?

- Will the collection agency be available whenever you need them?

Furthermore, the agency should offer ancillary services, such as:

- Dispute resolution

- Fraud investigations

- Business credit reporting

- Assets and liability reporting

These services reduce your expenses and improve your bottom line. Plus, it’s more convenient than having different firms performing related functions.

Frequently Asked Questions

Let’s address the most common questions:

1. Should You Share Personal Information With a Debt Collector?

You can share sensitive information with a reputable collection agency for verification purposes, but ensure the agency is not a scam. Scammers steal information for several reasons, including the following:

- Writing fraudulent checks

- Charging your credit cards

- Taking out loans in your business name

- Opening new credit cards and checking accounts

2. Is It Worth It to Hire a Collection Agency?

Hiring a collection agency is advantageous. They can help you recover lost income from bad debts and increase your recovery rates. But you must be cautious. Ensure the agency is licensed and has the experience to represent your company. You want to make the most of your investment.

3. What Questions Should You Ask Before Hiring a Collection Agency?

Here are five essential questions to ask before hiring a debt collector:

- Is the agency licensed or accredited?

- Will the agency handle skip tracing?

- What is their fee structure?

- What is their success rate?

- What tactics will they use to collect debt?

Contact Altus for Your Debt Collection Needs

Experienced collection agencies bring value, but finding a suitable option can be challenging. As a guide, choose the one with experience and a good track record in your industry. Human and technological resources are also important. You want a professional collection agency that provides exceptional customer service.

Altus is a globally renowned commercial collections firm. Our international network of trained, certified, and experienced professionals can help you increase debt recoveries. We also leverage advanced technology to optimize performance. Do you want to learn more about our offerings? Contact us now!