In recent years, the Federal Trade Commission has been clamping down on illegal collections. Consumers reported losing almost $8.8 billion to fraud in 2022, and impostor scams ranked at the top of that list. Though no one wants to become part of this statistic, it can be challenging to tell genuine debt collectors from fake ones over the phone.

Knowing how to tell if a debt collector is legit is essential to ensure your business doesn’t become a victim of collections fraud. Completing a few simple checks can make all the difference, allowing you to stop scammers in their tracks. As a business owner, you must work with authentic debt collectors to avoid financial or reputational damage.

What Are Collection Agency Scams?

Collection agency scams involve someone contacting you and claiming your business owes money. They’ll use various techniques to get you to pay, including phone calls, intimidation, and harassment. The debt could be fake, belong to someone else, or canceled. Fake debt collectors often refuse to provide a phone number or mailing address, or threaten to report you to law enforcement if you don’t pay.

If you get a phone call, text, or email regarding a debt you don’t recognize — or even if you do — it’s crucial to establish whether it’s real or if you’re a victim of one of the many collection agency scams.

How to Know if a Debt Collector Is Legitimate

Genuine debt collectors are easy to identify if you know what to look for. First, ask for a name, phone number, and street address. If your state requires debt collectors to have a license, request the license number as well. Refusal to give you this information is your first red flag.

If you have concerns about whether a debt collector is legitimate, you can confirm it with a debt validation notice. The Fair Debt Collection Practices Act requires debt collectors to provide specific information about the debt within five days of contacting you, so you can confirm whether the debt is yours. This validation notice often comes as an email. It must provide all the essential information associated with the debt, including the following:

- Names of the debt collector and the collector on the account

- The number connected to the debt

- The amount owed

- A statement detailing your debt collection rights

Only pay a collector after determining their authenticity.

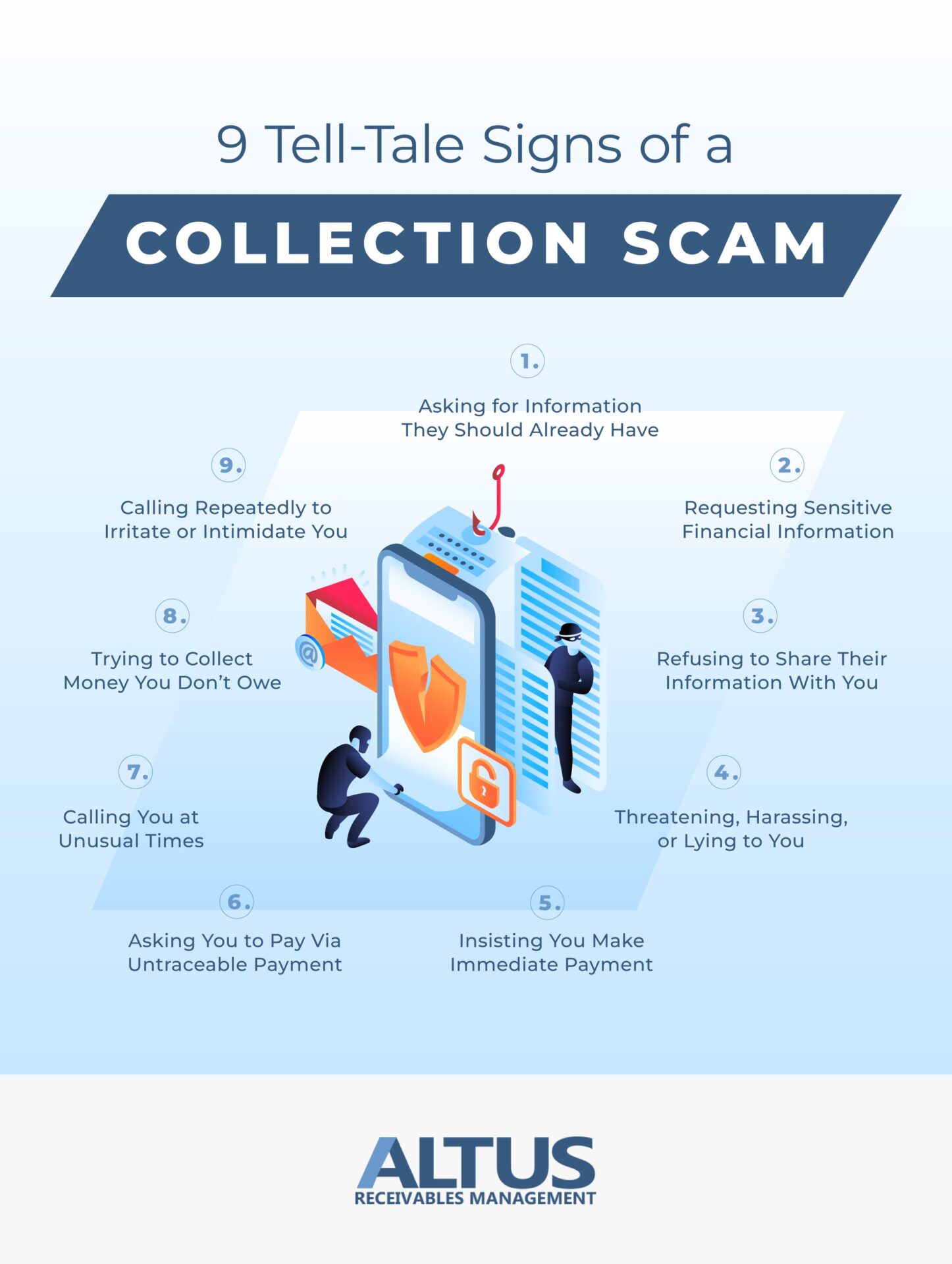

9 Ways to Spot Collection Scams

Debt collection scammers are inventive and can be challenging to spot. Remember the following tips and tricks to identify collection agency scams early.

1. Asking for Information They Should Already Have

Legitimate debt collectors should already have most of your information, like your debt status, birthday, and Social Security number. Scammers may have gotten some of your information, but not all. They may have scanned your credit statement to identify which businesses you owe money to. Still, they’ll ask for additional information to fill in the blanks.

2. Requesting Sensitive Financial Information

Anyone asking for a bank account, Social Security, or routing number could be trying to commit identity fraud. Only provide people with your sensitive financial information if you feel confident they’re genuine.

Even if you’ve received a validation letter and had multiple conversations with a debt collector, take considerable precautions before sharing your financial information. Consider it another red flag if the person asks you for sensitive personal or business details in the first phone call.

3. Refusing to Share Their Information With You

If someone calls you to collect a debt, ask them for as much information as possible, including the collector’s full name, company name, address, phone number, email, and website address. Insist on all these details and send the collection agency an email requesting confirmation of your debt in writing.

Do your research as well — search for the company online, call the number on their website, and check out some reviews. If the caller refuses to share any of the above information with you, there’s a good chance they are trying to scam you.

4. Threatening, Harassing, or Lying to You

By law, debt collectors may not pose as government officials, threaten to tell your business associates, family, or friends about your debt, or claim they will have you arrested if you don’t pay. Scammers want you to panic and pay immediately, so you won’t have time to evaluate whether the request could be a scam. They’ll be as intimidating as possible, making you overlook details you might immediately notice when you’re calm.

End the call and file a complaint if you feel threatened or intimidated. Remember, failure to pay could result in arrest if you owe criminal fines or restitution.

5. Insisting You Make Immediate Payment

Legitimate debt collectors will want to conclude the matter quickly. Still, if you’re speaking to someone particularly overbearing, you might have cause for concern. Creating a sense of urgency is in a scammer’s best interest, so you’ll pay first and ask questions later. Be cautious if you feel pushed to make immediate payments.

6. Asking You to Pay Via Untraceable Payment Methods

Fake debt collectors have to cover their tracks, so they often ask you to pay via untraceable options like Visa gift cards, wire transfers, and more. They often ask for payments of this nature in the first phone call. Though this is a definite red flag, stay calm and get their contact details.

On the other hand, real debt collectors accept regular, traceable payments. They offer various options suited to your needs and don’t try and push you to pay a specific way. If the caller’s suggested payment method seems suspicious to you, you’re probably on to something.

7. Calling You at Unusual Times

Legitimate debt collectors know they can’t call you at an inconvenient time or place. You could be dealing with a scammer if you receive calls outside office hours. Debt collectors can contact you at a reasonable hour on a Saturday, but calling on a Sunday is another giveaway, as collecting debts on a Sunday is illegal.

8. Trying to Collect Money You Don’t Owe

Legally, debt collection agencies contacting you must disclose the name of the creditor you owe money to and the amount you owe them. If you believe the debt isn’t yours or don’t owe anything, inform the caller you’ll send a written letter to dispute it.

9. Calling Repeatedly to Irritate or Intimidate You

If you ask a debt collector to stop calling you at work, they must do so. Legal debt collectors know repeated calls designed to harass or intimidate you are illegal, so they won’t engage in these behaviors.

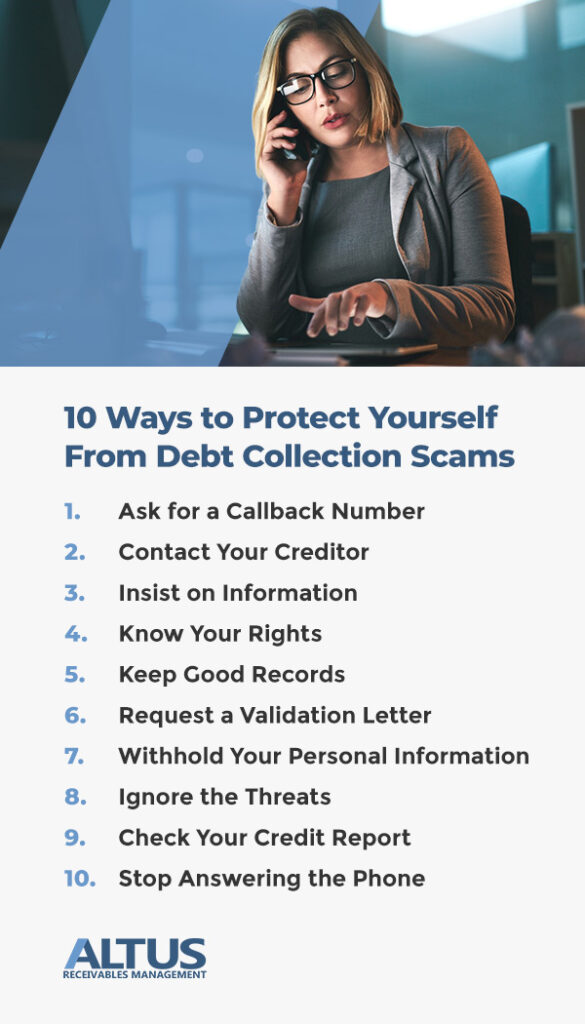

10 Ways to Protect Yourself From Debt Collection Scams

Despite the warning signs, debt collection scams can be extremely convincing. Keep this list of tips handy, so you know how to protect yourself.

1. Ask for a Callback Number

If you’re on a call that makes you uncomfortable, ask for a number to call back. You can Google this number, see if anyone else has reported a scam, and dial it yourself to verify you’re not dealing with a scammer. It could be a scam if someone answers under a different name or the number doesn’t work.

2. Contact Your Creditor

Any legitimate debt collector can provide you with the original creditor’s name. Contact them directly and ask them which company handles their collections.

3. Insist on Information

Refusing to part with personal information is often a serious red flag. Ask for all the details you can think of, including written notice of the debt. If you have not received any notification, request it before paying anything.

4. Know Your Rights

The FDCPA protects your rights as a debtor and prohibits debt collectors from using various tactics, including profanity, threats, and claiming to be a government official or lawyer to collect a debt.

5. Keep Good Records

Having up-to-date records is an excellent way of identifying scammers. If you know what you owe, and to whom, they have a reduced chance of convincing you otherwise.

Keeping up-to-date records can be a challenge for businesses, but it’s essential to have proof of all your transactions — not only to spot collections scams, but also to clear up any misunderstandings that could affect your credit score.

6. Request a Validation Letter

Regardless of whether a debt collection call sounds legitimate, you should always request a debt validation letter, as it requires the debt collector to prove they are legally collecting the debt. If they can’t prove they have a legal right to collect on the creditor’s behalf, there’s no need to deal with them anymore.

7. Withhold Your Personal Information

Legitimate debt collection agencies receive all your personal information from the creditor. Don’t give sensitive details to someone claiming to be a debt collector.

Similarly, don’t discuss any debts with someone who calls your business out of nowhere. Insist the caller provides you with the legal notice required by law before engaging in a conversation.

8. Ignore the Threats

The law prohibits collectors from threatening and harassing you or publicly revealing your debts. End the call if someone engages in any of these behaviors. Refrain from letting them fluster you into making immediate payments. Calmly insist on verification.

9. Check Your Credit Report

Credit reports don’t show every detail, but they can still be an excellent starting point for establishing whether a debt is legitimate. You have a legal right to check your credit report for free once a year, so do so if something suspicious pops up.

10. Stop Answering the Phone

Scammers are looking for easy targets, so one of the most effective ways to get them to move on to someone else is to stop answering their calls. Confirm that they are scammers before you take this step, as an authentic debt collector will need to work with you to resolve the debt.

What to Do if You Think a Debt Collector Is a Scammer

Once a scammer has targeted you, it’s best to take all the necessary steps to protect your identity and credit.

- Cut all contact: Only share your personal information if you’re sure your collector is legal. Scammers can use your information to steal your identity and cause costly damage.

- Report the collector: Stop the scammers from targeting anyone else by reporting them to the Consumer Financial Protection Bureau, the FTC, and local law enforcement.

How to Report Fake Debt Collectors

One of the most noticeable warning signs of a scammer is aggressive language. If your caller is threatening actions like arresting you, suspending your driver’s license, or calling your business associates, they are scamming or breaking the law. End the call and report the encounter directly to the FTC.

You can also submit a complaint with the CFPB if you think someone is trying to scam you or a legitimate debt collector is violating your rights. Another option is to report it to your state attorney general’s office.

If there your scam involved criminal activity, contact your local law enforcement.

How to Handle Legitimate Debt Collection Agencies

Having a debt collector call you is never pleasant. If your business is in debt, work with the agency to settle the matter immediately. Keep the following tips in mind to ensure a positive relationship with the collection agency.

Remember Your Rights

Legitimate debt collectors can get aggressive and take chances. For a quick recap, debt collectors may not:

- Call you outside the hours of 8 a.m. to 9 p.m. from Monday to Saturday.

- Continue to call if you’ve asked them to stop in writing.

- Call you repeatedly within a short period.

- Lie about their identity.

- Threaten you with violence.

- Discuss your debt with other people.

If a legitimate debt collector violates these rules on a call with you, tell them you will report them and hang up.

Stay Calm

Keep all conversations with a collection agency professional and impersonal. If the debt collector tries to make the conversation emotional, remind them of your rights and calmly inform them you won’t tolerate threats or abuse. Similarly, refrain from being abusive yourself.

Answer the Calls

Ignoring a legitimate debt collector about your debt with cause further harm to your credit score and report. Answer the phone when they call and let them give you the information about the debt. Request the paperwork and make plans to settle the outstanding amount soonest.

Discuss Your Options

Once you have verified the debt is yours and received your validation letter, discuss the debt repayment with the debt collector. If you can pay the amount upfront, it’s best to do that. Alternatively, ask if you can set up a payment option that works for your business and the agency.

Stick With Legitimate Debt Collectors and Contact Altus Today

Your collections are integral to your business’ bottom line and reputation. You need someone you can trust to work on your business’ behalf and collect customer debts using methods prioritizing compliance and high recovery rates. Our powerful, customer-focused collection system automates and streamlines critical functions of the debt collections process, allowing you to stay ahead of the curve and boosting cash flow throughout your organization.

Contact us today to learn more about how Altus can help you elevate compliance and overhaul your collections strategies and results. See why we are North America’s No. 1 commercial collections firm.