First-party and third-party collections play an essential role in the debt collection process. In first-party collections, an organization uses its internal team to collect debts or acquire the services of an agency. With third-party collections, an external agency runs the collections efforts. Understanding the differences between the two will help you know what to do with your outstanding accounts and what process to follow. Learn more about what first- and third-party collections are and their differences.

Defining First-Party and Third-Party

The first-party collection is typically the first action when a business has an outstanding debt. When clients owe money to a company, that company is the first party. The company follows up with its clients directly to pay the due amount. Companies turn to third-party collection agencies when a debt has been outstanding for a certain period.

What Are First-Party Collections?

First-party collections are when the original creditor seeks to recover money owed to them. The outstanding debt can be in the form of a loan, credit card debt, payment for services, medical bills, or other types of debt. The business that approved the loan or provided the goods or services is the first party. Some larger companies have in-house teams that manage their accounts receivable (AR) department. These teams use their resources to try to collect the debt by a specific period before writing off the debt.

Businesses can also look to agencies to act as first-party collectors on their behalf. This option is especially beneficial for smaller organizations or creditors that lack resources. An agency uses the internal strategies of the business to collect the debt on its behalf. The agency acts as an extension of the first party and collects the money while maintaining customer relationships with the original creditor.

How does first-party debt collection work? The original creditor or collection agency sends reminders, communicates with the client, resolves disputes, and creates and monitors payment plans, among other collection processes.

At Altus, our first-party debt collections services help bolster your accounts receivable team. Our cost-effective collections solution opens up resources to scale your AR department and collect your debts on time. We manage your accounts receivable on your behalf and communicate with your customers in a way that appears to be your company.

What Are Third-Party Collections?

Third-party collection is usually the next stage after the original creditor writes off the debt or it’s been through the delinquency and default stage. When a business considers a debt uncollectible, it will close the account and assign it to a third-party collector. It’s called third-party collection because the new collector was not part of the original contract. An original creditor can choose to go about the third-party collection in one of the following ways:

- The original creditor keeps ownership of the debt and acquires the services of a third-party collector for a fee. The agreed-upon amount will either be a flat or contingency fee.

- The original creditor sells the debt to a third-party collector, which will then collect it.

- The original creditor seeks litigation services from a third-party collector, which will recover the debt using legal proceedings.

Outsourcing the debt collection to a third party frees the organization to focus its time and energy on other accounts. While companies may be concerned about losing control, they can work with the collections agency to maintain excellent customer service and restore the client relationship.

So how does third-party debt collection work? The debt collection may vary depending on the company collecting the debt. Some collection agencies only collect a specific type of debt, such as credit cards or mortgage loans. Others only deal with debts of a particular age and won’t collect a debt past the statute of limitations, which differs depending on location.

At Altus, we are a reputable third-party collection agency, and we use sound legal practices to cover debts for our clients. When you hand your accounts over to us, we do due diligence to ensure you receive the return you deserve. If you have a challenging collection that requires legal action, we offer pre-litigation services through a partnership with the Collections Law Office.

What’s the Difference?

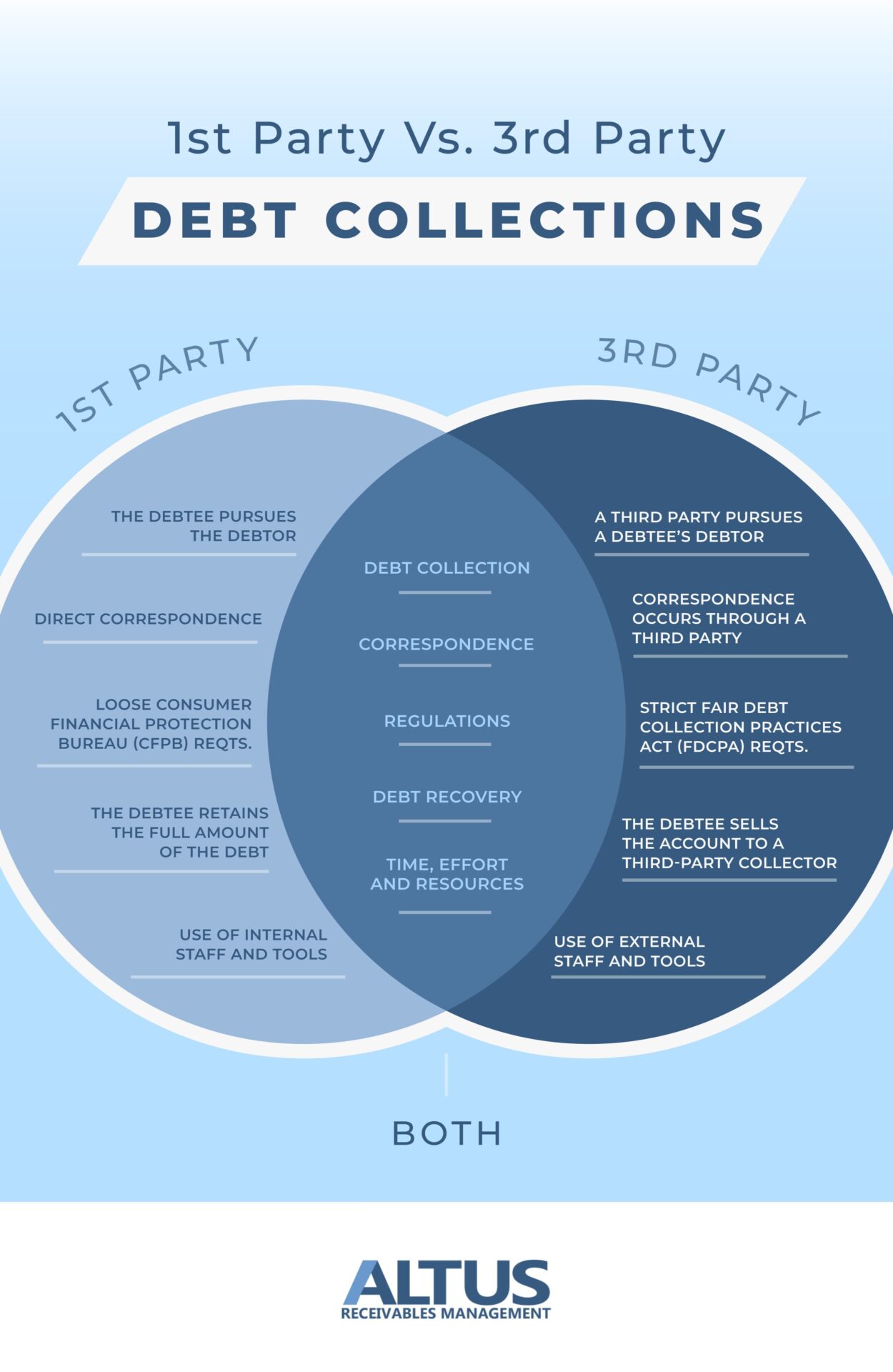

One of the main differences between first-party and third-party collections is the regulations that they follow. Third-party regulations are more stringent under the Fair Debt Collection Practices Act (FDCPA) than the ones first-party collectors need to uphold. The leeway for first-party collectors is mainly because the contract details between them and the debtor offer them protection. Once the original creditor hands over the account to a third party, the FDCPA ensures they follow fair collection processes.

Even though the FDCPA doesn’t have strict guidelines for original creditors, the Consumer Protection Financial Bureau (CFPB) ensures that creditors treat their customers fairly.

In the first-party collection process, the business retains the total amount of the debt, primarily if it collects in-house. Outsourcing to a third party means an organization must pay a fee. First-party collections give organizations more control over the tone of correspondence with the client, but with a third party, the creditor has less visibility and control over the communications. Third-party agencies have to adhere to FDCPA guidelines, which gives added assurance that they will treat your clients fairly.

Outsourcing to a third party frees up your internal team and resources to focus on other tasks while the debt is collected. Third-party collectors have access to collection technologies and expertise that you may not have in your organization. Agencies also have an improved chance of recovering the debt in less time because of their knowledge and experience. Working with a third-party collector has cost-effective and efficient benefits for your business in handling delinquent accounts.

Which Is Right for You?

Most businesses will likely need both first-party and third-party collections at some stage. Ideally, all your customers pay their debts on time. Some will likely need reminders, and you may even find yourself setting up payment plans for others. These tasks all fall under first-party collections. When an account becomes delinquent or you have to write it off, you’ll need the expertise of a third-party collection agency.

Whether you choose to outsource first- and third-party collections depends on whether you have the time, knowledge, and resources to create an in-house accounts receivable team. Many businesses need external support from a commercial collection agency. Even with an in-house team, a collection agency can support your AR management. Finding a reputable collection agency is essential to maintaining a good relationship with your customers and successfully collecting accounts.

Altus is a leading commercial collections firm. We combine our expertise and collection technologies to offer our clients sophisticated services. You can extend your internal collections to us to enhance portfolio coverage and overall accounts receivable management. When you choose us for third-party collections, you gain access to the largest commercial collections company in North America. We have the resources to help you get the return you deserve.

Access Leading Debt Collection Services With Altus

First-party collections are when an organization focuses on collecting outstanding debts. An organization can recover accounts in-house or extend the recovery process to a first-party collection agency. Organizations turn to a third-party collection agency once a debt is delinquent. Third-party collectors have the expertise to recover the debt efficiently and effectively. Depending on whether your debt is outstanding or written off will determine which form of collection you need.

At Altus, we offer first-party and third-party collection services to businesses of all sizes and industries. We offer the highest recovery rates while maintaining healthy relationships with your clients. Maximize your accounts receivable — contact us today to learn more!